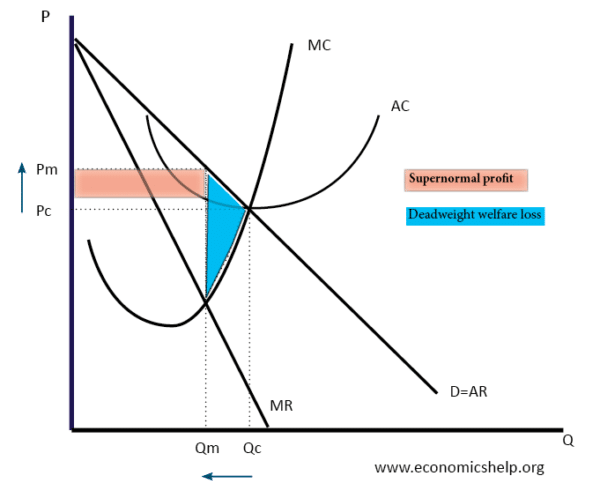

In the UK, the office of fair trading can investigate the abuse of monopoly power. If it is set too high, the firm can abuse its monopoly power.Ħ. Also, rate of return regulation may fail to evaluate how much profit is reasonable. Rate of return regulation gives little incentive to be efficient and increase profits. This is when firms allow costs to increase so that profit levels are not deemed excessive. If the firm is making too much profit compared to their relative size, the regulator may enforce price cuts or take one-off tax.Ī disadvantage of the rate of return regulation is that it can encourage ‘cost padding’. Rate of return regulation looks at the size of the firm and evaluates what would make a reasonable level of profit from the capital base. This is a different way of regulating monopolies to the RPI-X price capping. This tends to be seen as an extreme step, and there is no guarantee the new firms won’t collude.ĥ. For example, the US looked into breaking up Microsoft, but in the end, the action was dropped. In certain cases, the government may decide a monopoly needs to be broken up because the firm has become too powerful. For example, CMA blocked the merger between Sainsbury’s and Asda as being against the public interest.The CMA can decide to allow or block the merger depending on whether it believes it is in the public interest. If a new merger creates a firm with more than 25% of market share, it is automatically referred to the Competition and Markets Authority (CMA). The government has a policy to investigate mergers which could create monopoly power. not allow a monopoly to cut off gas supplies in winter. In gas and electricity markets, regulators will make sure that old people are treated with concern, e.g. For example, the rail regulator examines the safety record of rail firms to ensure that they don’t cut corners. Regulators can examine the quality of the service provided by the monopoly. If a firm becomes very efficient, it may be penalised by having higher levels of X, so it can’t keep its efficiency saving.However, firms may argue regulators are too strict and don’t allow them to make enough profit for investment.There is a danger of regulatory capture, where regulators become too soft on the firm and allow them to increase prices and make supernormal profits.It is costly and difficult to decide what the level of X should be.In the absence of competition, RPI-X is a way to increase competition and prevent the abuse of monopoly power. Arguably there is an incentive to cut costs. If a firm cut costs by more than X, they can increase their profits.The regulator can set price increases depending on the state of the industry and potential efficiency savings.Thus, if water companies need to invest in better water pipes, they will be able to increase prices to finance this investment. K is the amount of investment that the water firm needs to implement. In water, the price cap system is RPI -/+ K. In the early years of telecom regulation, the level of X was quite high because efficiency savings enabled big price cuts. If the regulator thinks a firm can make efficiency savings and is charging too much to consumers, it can set a high level of X.

Then firms can increase actual nominal prices by 3-1 = 2%.

Therefore, we cannot encourage competition, and it is essential to regulate the firm to prevent the abuse of monopoly power.įor many newly privatised industries, such as water, electricity and gas, the government created regulatory bodies such as:Īmongst their functions, they are able to limit price increases. Some industries are natural monopolies – due to high economies of scale, the most efficient number of firms is one. In some industries, it is possible to encourage competition, and therefore there will be less need for government regulation.

For example, supermarkets may use their dominant market position to squeeze profit margins of farmers. A firm with monopoly selling power may also be in a position to exploit monopsony buying power. Government regulation can ensure the firm meets minimum standards of service. If a firm has a monopoly over the provision of a particular service, it may have little incentive to offer a good quality service. This would lead to allocative inefficiency and a decline in consumer welfare. Without government regulation, monopolies could put prices above the competitive equilibrium.

0 kommentar(er)

0 kommentar(er)